The Telecom Regulatory Authority of India (TRAI) is now trying to reduce SMS spamming using Artificial Intelligence (AI) and Machine Learning (ML) in the country. TRAI was the first authority in the world that previously implemented the use of blockchain-based application that would look for unexpected calls and messages in transit and scrub them before it reaches to users or the network itself.

However, the solution saw mixed results after there were several reports of it scrubbing legitimate messages like One Time Passwords (OTP) as well. This led the authority to suspend the application altogether, with people relying on third-party spam blocking applications like Truecaller and Google Messages.

Unsolicited commercial communication or UCC has become a major concern in the country. Even after registering their numbers on TRAI's National Do Not Call (NDNC) registry, almost all Indian phone numbers are prone to spam text messages everyday from various unregistered telemarketers (UTM).

The Department of Telecommunication (DOT) had also planned to levy fines ranging from ₹1,000 per violation for 0-10 breaches, ₹5,000 each for 10-50 breaches, and ₹10,000 each for more than 50 breaches by registered telemarketers. However, the department is yet to implement the rule. Now, TRAI is trying new methods to curb spam messages.

The regulator announced in a press release (PDF) new methods that will significantly reduce spam messages.

TRAI in coordination with various stakeholders is taking necessary steps to check UCC from UTMs also. These steps include- implementation of UCC detect system, provision of Digital Consent Acquisition, intelligent scrubbing of the Headers & Message templates, using AI (Artificial Intelligence) & ML (Machine Language), etc.

The regulatory body also announced the formation of a Joint Committee of Regulators (JCR) that will comprise of TRAI itself, the Reserve Bank of India (RBI), the Securities and Exchanges Board of India (SEBI), and the Ministry of Consumer Affairs (MoCA). The committee will work to curb financial frauds that happen over phone or text messages.

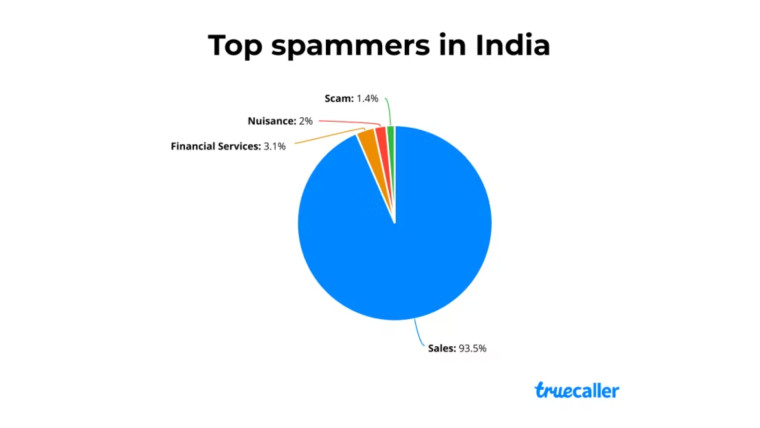

According to a report from Truecaller, one spammer alone made over 202 million spam calls in 2021. Majority of the spam calls in India are sales or telemarketing calls. Another popular spam genre remains the KYC (know your customer) scam where a scamster pretends to be a representative from a bank or a digital payment service asking for documents mandated by the RBI.

Plenty of spam text messages and calls also make it outside the Indian borders which makes it even more important to regulate.

Although unwanted SMS can be tackled by the authority, it cannot do much to address WhatsApp spams until the internet-based messaging app takes an initiative itself.

Source: TRAI [PDF] (via The Register)